David Enke

Associate Dean, Kummer College

Professor

Engineering Management and Systems Engineering

- enke@mst.edu

- Phone: (573) 341-4749

- 221 Engineering Management Building

Research Interests:

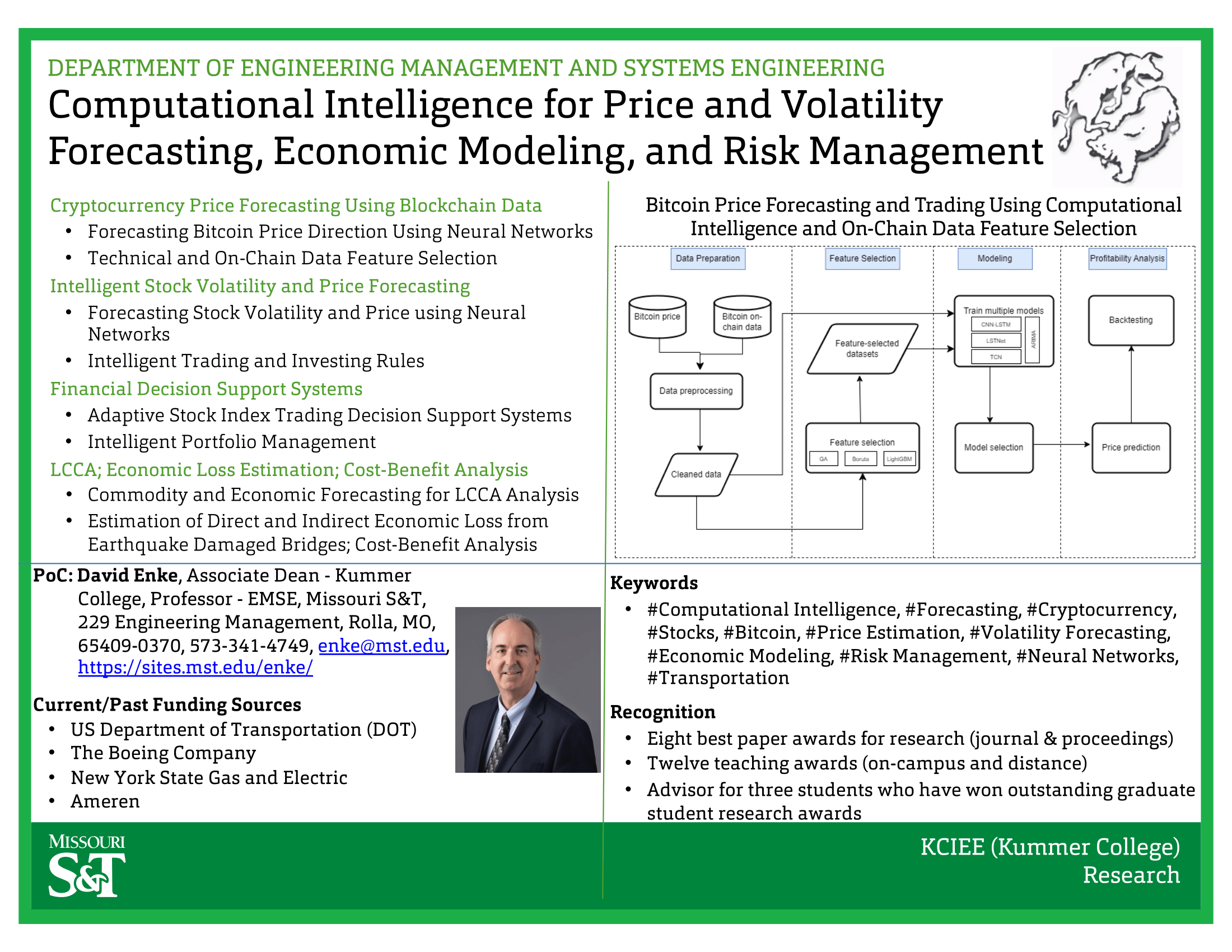

Equity price and volatility forecasting, using options and futures for hedging and financial modeling, hedge fund replication, endowment investing, developing adaptive trading systems using computational intelligence (such as artificial neural networks, fuzzy logic, and evolutionary systems), enterprise risk management, trading strategies, cryptocurrencies, and decentralized finance.

Publications:

Resume/CV:

Personal Website:

- VOLATILITY AND PRICE FORECASTING FOR FINANCIAL RISK MANAGEMENT

- Indirect Cost Estimation

VOLATILITY AND PRICE FORECASTING FOR FINANCIAL RISK MANAGEMENT

VOLATILITY AND PRICE FORECASTING FOR FINANCIAL RISK MANAGEMENT USING MACHINE LEARNING, CLUSTERING, AND DIMENSIONALITY REDUCTION

INVESTIGATORS

David Enke (enke@mst.edu, 573-341-4749)

FUNDING SOURCE

Engineering Management and Systems Engineering, Missouri S&T

PROJECT DESCRIPTION

For financial risk management, it is important, albeit challenging, to forecast the direction of the stock market return, as well as the volatility of the return time series. Among the previous studies that focus on predicting stock market returns and volatility, the data mining procedures that are often utilized to identify predictive input variables are either incomplete or inefficient, especially when a large amount of features are involved. Current research is focusing on developing a complete and efficient data mining procedure to forecast the daily direction of the return and volatility for a stock market index based on 60 financial and economic features. Initial work has studied three existing dimensionality reduction techniques, including principal component analysis (PCA), fuzzy robust principal component analysis (FRPCA), and kernel-based principal component analysis (KPCA), each of which has been applied to a historical data set to simplify and rearrange the original data structure. Fuzzy c-means and other computational intelligence models are also being utilized for clustering the preprocessed data. Corresponding to different levels of dimensionality reduction, multiple new data sets are generated from the entire cleaned data set using the tested dimensionality reduction methods. Artificial neural networks (ANNs), logistic regression, and other classification approaches are then used with the transformed data sets to classify and forecast the daily direction of future market returns. Hypothesis tests on the initial classification and simulation results show that combining ANNs with PCA gives higher classification accuracy. In addition, the risk management and trading strategies guided by the comprehensive classification mining procedures based on this hybrid model gain significantly higher risk-adjusted profits compared to standard benchmarks. As with return forecasting, ANNs are also providing an advantage over traditional statistical approaches, such as EWMA and GARCH models, for forecasting the volatility of financial time series. On-going research continues to develop and study new dimensionality reduction techniques and clustering approaches for identify predictive inputs, as well as developing and testing new machine-learning models and other forms of computational intelligence for classification and forecasting.

RECENT RELEVANT PUBLICATIONS

1) “Forecasting Daily Stock Market Return Using Dimensionality Reduction,” Zhong, X., and D. Enke, Expert Systems with Applications, Vol. 67 (2017): 126-139.

2) “Using Neural Networks to Forecast Volatility for an Asset Allocation Strategy based on the Target Volatility,” Kim, Y., and D. Enke, to appear in Procedia Computer Science, 2016.

3) “An Adaptive Stock Index Trading Decision Support System,” Chiang, W.C., D. Enke, T. Wu, and R. Wang, Expert Systems with Applications, Vol. 59 (2016): 195-207.

4) “A Rule Change Trading System for the Futures Market using Rough Set Analysis,” Kim, Y.M., and D. Enke, Expert Systems with Applications, Vol. 59 (2016): 165-173.

5) “Noise Canceling in Volatility Forecasting Using an Adaptive Neural Network Filter,” Almasi Monfared, S., and D. Enke, Procedia Computer Science, Vol. 61 (2015): 80-84.

6) “Optimizing MACD Parameters via Genetic Algorithms for Soybean Futures,” Wiles, P.S., and D. Enke, Procedia Computer Science, Vol. 61 (2015): 85-91.

7) “Interest Rate Prediction: A Neuro-Hybrid Approach with Data Preprocessing,” Mehdiyev, N., and D. Enke, International Journal of General Systems, Vol. 43, No. 5 (2014): 535-550.

8) “A Hybrid Neuro-Fuzzy Model to Forecast Inflation,” Enke, D., and N. Mehdiyev, Procedia Computer Science, Vol. 36 (2014): 254-260.

9) “Nonlinear Modeling using Neural Networks for Trading the Soybean Complex,” Wiles, P.S., and D. Enke, Procedia Computer Science, Vol. 36 (2014): 234-239.

10) “Volatility Forecasting using a Hybrid GJR-GARCH Neural Network Model,” Almasi Monfared, S., and D. Enke, Procedia Computer Science, Vol. 36 (2014): 246-253.

11) “Hedge Fund Replication using Liquid ETFs and Regression Analysis”, Subhash, S., and D. Enke, Proceedings of the 2014 Industrial and Systems Engineering Research Conference, Y. Guan and H. Liao, editors, Montreal, Canada, 2014.

12) “Type-2 Fuzzy Clustering and a Type-2 Fuzzy Inference Neural Network for the Prediction of Short-Term Interest Rates,” Enke, D., and N. Mehdiyev, 2013 Complex Adaptive Systems, Vol. 20 (2013): 115-120.

13) “Performance Evaluation of Neural Networks and GARCH Models for Forecasting Volatility and Option Strike Prices in a Bull Call Spread Strategy,” Vejendla, A., and D. Enke, Journal of Economic Policy and Research, Vol. 8, No. 2 (2013): 1-19.

14) “Stock Market Prediction using a Combination of Stepwise Regression Analysis, Differential Evolution-Based Fuzzy Clustering, and a Fuzzy Inference Neural Network,” Enke, D., and N. Mehdiyev, Intelligent Automation and Soft Computing, Vol. 19, No. 4 (2013): 636-648.

15) “Evaluation of GARCH, RNN, and FNN Models for Forecasting Volatility in the Financial Markets,” Vejendla, A., and D. Enke, IUP Journal of Financial Risk Management, Vol. X, No. 1 (2013): 41-49.

16) “Forecasting US Short-term Interest Rates using a Fuzzy Inference Neural Network,” Enke, D., and N. Mehdiyev, ICAFS – 2012: Tenth International Conference on Applications of Fuzzy Systems and Soft Computing, CD-ROM Proceedings, 2012.

17) “A New Hybrid Approach For Forecasting Interest Rates,” Enke, D., and N. Mehdiyev, Procedia Computer Science, Vol. 12 (2012): 259-264.

Indirect Cost Estimation

Applying a Regional CGE Model for Estimation of the Indirect Economic Loss due to Damaged Highway Bridges

INVESTIGATORS

David Enke (enke@mst.edu, 573-341-4749), Ronaldo Luna, and Chakkaphan Tirasirichai

FUNDING SOURCE

Federal Highway Administration

PROJECT DESCRIPTION

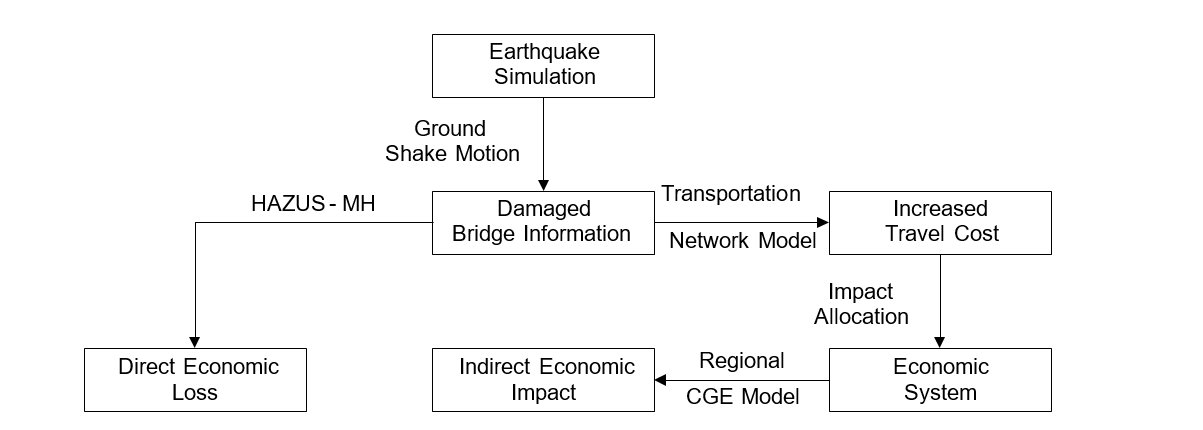

Destruction from natural and man-made disasters can result in extensive damage to the affected area’s infrastructure. While resulting in costs that are necessary to restore the physical destruction and repair of existing infrastructure, a wider economic impact is often indirectly measured and felt. Policymakers generally focus only on the losses that are directly caused by the destruction, such as the replacement of roads and bridges, yet tend to overlook the consequences from indirect economic losses. This research examines a framework to estimate the indirect economic loss due to damaged bridges within the highway system of a major metropolitan area. For the research, a simulated earthquake within the St. Louis metropolitan region was selected as a case study. A Computable General Equilibrium (CGE) model is applied as the loss estimation tool for modeling the indirect cost. Initial research has shown that the indirect loss is significant when compared to the direct loss, and should therefore be considered by policy makers when making both pre- and post-disaster infrastructure decisions.

PUBLICATIONS

1.) "Estimation of Earthquake Loss due to Highway Damage in the St. Louis Metropolitan Area: Part II - Indirect Loss.” Enke, D., C. Tirasirichai, and R. Luna, ASCE Natural Hazards Review, Vol. 9, No. 1 (2008): 12-19.

2.) “Case Study: Applying a Regional CGE Model for Estimation of the Indirect Economic Loss due to Damaged Highway Bridges,” Tirasirichai, C. and Enke, D., The Engineering Economist, Vol. 52, 2007: 367-401.

Follow Intelligent Systems Center